This post is brought to you by The Huntington National Bank and The Motherhood. All opinions are my own.

You guys know that feeling when you’re scrolling through Facebook or social media and you see those family photos with your friends taking their kids on vacation or to Disney and you just wish that you could squeeze something like that into your budget. Or maybe you see an old friend holding up keys to their brand-new house and you wonder how they could afford that. We’ve all been there and we all know we are guilty of sharing the BEST parts of our lives online while we cover up the lower points–like struggling financially or maxing out a credit card to take that vacation, or trying to get out of overwhelming student loan debt, or perhaps trying to cover unforeseen expenses all while affording childcare, sports, and everyday costs for our families. But that doesn’t make it online to boast about now does it?? Admittedly, family finance goals are probably the number one thing on my mind daily, as well as into the future…it is a constant uphill battle to determine what you can afford, what you should spend money on, when you should save…and it all starts by setting your own personal priorities for you and your family.

This year I am excited to announce that I am working with Huntington Bank and will serve as a brand ambassador. What this means for you is more real life talk and discussion about finances and getting a little real and personal about how my husband and I handle ours with the help of Huntington Bank. But first, I want to share with you our own #FamilyFinanceGoals (sticking with the social media theme) that we prioritize each year and the “why” behind why we choose that way.

Table of Contents

Saving for Vacation…

Since we had kids, the one thing over anything else that I prioritize is spending time with my family. As my 30’s have rushed past me and I watch as my son is turning 10 this year, one thing I realized that I cannot get back is time. Time is precious. I don’t have time to miss out on opportunities to spend time with my kids, so our personal family finance goal is to be able to travel at least once per year (sometimes more) with our kids on regular vacations so that we can make memories, visit new places, and just be together.

Nothing…and I mean NOTHING…warms my heart more than to hear my kids tell me how much fun they are having with us, how great one of the trips we took was, or that they can’t wait to take another vacation with us soon. My kids are little now and still enjoy being with mom and dad, but I realize that soon enough those thoughts will change, so saving money for vacation each year is an absolute priority for us–even if it’s just a simple vacation to the lake a few hours away or a longer trip down the Carolina coast. For my family, traveling and exploring together is a priority.

Saving for Education…

Next up…saving for education. Of course, My husband and I have far more extensive financial goals than just vacation savings, so we do prioritize setting aside a little each month for our children’s education, as well as setting aside money to finish paying off our own student loans (we’re getting there!) While we don’t know what their plans will be in the future, we do want to ensure that we’re not crippled financially when they do make their decision and we also hope that we are able to leave them in a place where they’re not struggling with the student loan debt that we once did.

Saving for Retirement…

Another hot topic of conversation is saving for retirement. We also focus on this because time flies when you’re having fun and we want to be prepared! I just read this week that Americans are not doing their due diligence to save well in advance of retirement, so if you don’t have something set up yet, now is the time to get started. My husband and I just started with a low amount and have it set to automatically increase by a percentage every single year. Rather than trying to save 10% of your pay right away, start by trying to save 1%, then next year try 2%…or if you save by amount, start with $25 and have it increase each year by $10. Increasing by small amounts each year makes it more palatable to your budget where over time you don’t even realize it’s not there!!

Saving for Emergencies…

The final thing we’re working on doing is to save for emergencies. We try to keep $1000 on hand at all times for those moments when car repairs pop up, unforeseen costs arise, or when we just need the money for something unexpected.

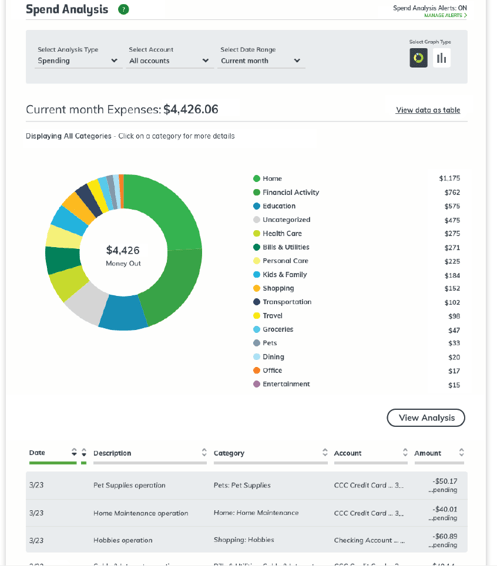

Huntington Bank’s Spend Analysis helps us tremendously with our savings because they allow us to analyze our spending and where our money is going. Sometimes when you get that visual of all the coffee you’re buying or shopping you’re doing, you realize that you need to rein it in and you find ways to cut back so you can save more!

Once you see WHERE you can cut back, Huntington Bank gives you the tools to set savings goals within their banking app. You can set your goals to reflect what you’re saving for so you can see where you’re at with each goal! I love this because all too often with some savings accounts you just see a lump sum, but this gives you the option to break your savings into different smaller, attainable goals!

As part of my Ambassadorship for the year, I recently had the unique opportunity to visit Huntington Bank Headquarters in downtown Columbus and learn more about who they are and what they do. My husband and I have personally been banking with Huntington Bank for 5+ years now and haven’t regretted that choice for one moment. My favorite thing about Huntington Bank is their invention of 24-Hour Grace ®, which gives you more time to make a deposit in order to avoid an Overdraft fee, if by chance you overdraw. We all have times when we lose track of our finances and Huntington is not the bank that aims to profit from your oversight, which is just one step closer to showing why they are a step above all the rest. Learn more at www.huntington.com/grace

Our friends at Huntington showed us all the ways that they are working to be the best in the biz and really focus on making the customer experience a personal one. Because I’ve been a lifelong Ohio resident, it’s nice to know that the people I’m trusting with all my money are located close and it’s even better to see all the hard work that goes into making your banking experience a positive one and that reflects daily with the ease of using their services and their responsiveness when or if a situation arises.

For me, Huntington Bank is what we all want from our bank…peace of mind. They see our struggles, they adapt to our goals, and they help us do better with our money no matter what level of experience we have in handling it. I’m excited to show you more about all that Huntington Bank has to offer this year and why we are proud Huntington Bank customers!